|

|

| Rank | Posts | Team |

| International Chairman | 14845 | No

Team

Selected |

| Joined | Service | Reputation |

| Dec 2001 | 23 years | |

| Online | Last Post | Last Page |

| Oct 2021 | Jul 2021 | LINK |

| Milestone Posts |

|

| Milestone Years |

|

|

| Location |

|

| Signature |

|

TO BE FIXED |

|

| Quote ="Hull White Star"Well thats thousands of Public Sector workers who can afford to buy in St Albans then according to some on here.'"

That's true - the area is full of them. Especially at lunchtime - when the young retirees live it up with expensive pub lunches on their hefty pensions.

Last night Mrs D was out with a friend who recently packed up working with the local authority. She was the lowest paid member of dept but they can't cope without her - because the more senior people are so hopeless. They have asked her to go back on [utriple[/u the salary - not bad in times of 25% cuts, hey? It's bloo** ludicrous how the petty beaurocrats can always find money to cover their inept backsides but not for the services to help the people they are supposed to. |

|

|

| Rank | Posts | Team |

| Player Coach | 2359 | No

Team

Selected |

| Joined | Service | Reputation |

| Nov 2005 | 19 years | |

| Online | Last Post | Last Page |

| Feb 2021 | Feb 2020 | LINK |

| Milestone Posts |

|

| Milestone Years |

|

|

| Location |

|

| Signature |

|

TO BE FIXED |

|

| Quote ="Dally"That's true - the area is full of them. Especially at lunchtime - when the young retirees live it up with expensive pub lunches on their hefty pensions.

Last night Mrs D was out with a friend who recently packed up working with the local authority. She was the lowest paid member of dept but they can't cope without her - because the more senior people are so hopeless. They have asked her to go back on [utriple[/u the salary - not bad in times of 25% cuts, hey? It's bloo** ludicrous how the petty beaurocrats can always find money to cover their inept backsides but not for the services to help the people they are supposed to.'"

As a consultant by any chance?? If it was for the same role the salary is scaled and cannot suddenly be tripled. |

|

|

|

| Rank | Posts | Team |

| International Chairman | 37704 | No

Team

Selected |

| Joined | Service | Reputation |

| May 2002 | 23 years | |

| Online | Last Post | Last Page |

| Aug 2018 | Aug 2018 | LINK |

| Milestone Posts |

|

| Milestone Years |

|

|

| Location |

|

| Signature |

|

TO BE FIXED |

|

| Quote ="Dally"That's true - the area is full of them. Especially at lunchtime - when the young retirees live it up with expensive pub lunches on their hefty pensions.

Last night Mrs D was out with a friend who recently packed up working with the local authority. She was the lowest paid member of dept but they can't cope without her - because the more senior people are so hopeless. They have asked her to go back on [utriple[/u the salary - not bad in times of 25% cuts, hey? It's bloo** ludicrous how the petty beaurocrats can always find money to cover their inept backsides but not for the services to help the people they are supposed to.'"

I reckon she'll be returning on a per diem, consultative basis, rather than as a full-time employee and as such, that's not far from the norm that they'd expect to pay an agency for someone without the necessary experience. Sounds cheap to me |

|

|

| Rank | Posts | Team |

| Player Coach | 8893 | No

Team

Selected |

| Joined | Service | Reputation |

| May 2006 | 19 years | |

| Online | Last Post | Last Page |

| Apr 2024 | Apr 2024 | LINK |

| Milestone Posts |

|

| Milestone Years |

|

|

| Location |

|

| Signature |

|

TO BE FIXED |

|

| Quote ="Dally"Our local 'paper pointed out that average house prices in St Albans are a little over £430,000 and that if someone gets a mortgage with a 25% deposit (which will be nearly £110,000) they need a salary of £90,000 pa to get a mortgage.

'"

What salary do they need to actually be able to afford that mortgage? |

|

|

| Rank | Posts | Team |

| Moderator | 12662 | No

Team

Selected |

| Joined | Service | Reputation |

| Jun 2007 | 18 years | |

| Online | Last Post | Last Page |

| Jan 2025 | Jan 2025 | LINK |

| Milestone Posts |

|

| Milestone Years |

|

|

| Location |

|

| Signature |

|

TO BE FIXED |

Moderator

|

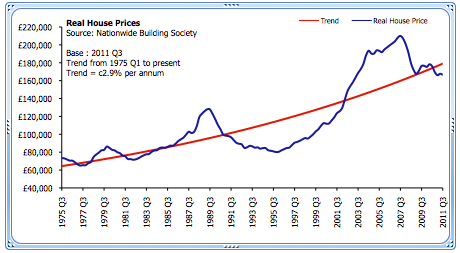

| Quote ="sally cinnamon"The massive growth in house prices between 1996 to 2006 was well above long term trend and there was obviously scope to fall from then. I think house prices have stabilised now though. I expect that that big growth in house prices will not be repeated any time in the next few decades as wage growth is likely to be low for some time and lenders are unlikely to go crazy making the loans they did in the late 1990s and early 2000s so that will depress demand.

Nationwide's index of house prices suggests that they have now returned more or less to trend from 1975 to present. It would have been healthier for the economy if growth had followed that smooth red line.

That graph is in real house prices by the way, ie adjusted for inflation to todays price, when it says the average house cost £65k in 1977, the actual average price then was around £13k, but that would be £65k in todays money.'"

It's interesting that prices have risen 2.9% above inflation (on average), over such a long period. I'd expect a period of [ureal[/u house prices falling, without the actual ticket price dropping too much. A readjustment is necessary and healthy. That's best case - the bottom could still fall out of things completely into a downward spiral, I guess. That wouldn't last forever, but as you say, a smoother line is better. A less steep one too, IMO. |

|

|

|

| Rank | Posts | Team |

| International Chairman | 37704 | No

Team

Selected |

| Joined | Service | Reputation |

| May 2002 | 23 years | |

| Online | Last Post | Last Page |

| Aug 2018 | Aug 2018 | LINK |

| Milestone Posts |

|

| Milestone Years |

|

|

| Location |

|

| Signature |

|

TO BE FIXED |

|

| Quote ="Mild Rover"It's interesting that prices have risen 2.9% above inflation (on average), over such a long period. I'd expect a period of [ureal[/u house prices falling, without the actual ticket price dropping too much. A readjustment is necessary and healthy. That's best case - the bottom could still fall out of things completely into a downward spiral, I guess. That wouldn't last forever, but as you say, a smoother line is better. A less steep one too, IMO.'"

The only time any downwards re-adjustment will occur is if there's a release of suitable land and affordable houses onto the market, all the time that demand outstrips supply, prices will ineviatably increase.

The strange thing is, there's thousands of acres of suitable land available, much of it owned by local authorities and government agencies and that's without all the landbanking that's been taking place over the last 20 years or so. If the owners of this land were to be charged an annula land tax, based on the theoretical maximum developed potential of the land, the market would be flooded.

There's also 1 million long-term, empty houses in this country that could be turned over to the 2 million looking for a home of their own. It's time we moved away from the marketisation of homes and returned them to being primarily places to live.

Watch [url=http://www.channel4.com/programmes/phils-empty-homes-giveaway/4odPhil's empty homes giveaway[/url |

|

|

| Rank | Posts | Team |

| International Chairman | 14845 | No

Team

Selected |

| Joined | Service | Reputation |

| Dec 2001 | 23 years | |

| Online | Last Post | Last Page |

| Oct 2021 | Jul 2021 | LINK |

| Milestone Posts |

|

| Milestone Years |

|

|

| Location |

|

| Signature |

|

TO BE FIXED |

|

| Quote ="cod'ead"The only time any downwards re-adjustment will occur is if there's a release of suitable land and affordable houses onto the market, all the time that demand outstrips supply, prices will ineviatably increase.

'"

When interest rates /nemployment rise, prices will drop. |

|

|

| Rank | Posts | Team |

| International Board Member | 8633 | No

Team

Selected |

| Joined | Service | Reputation |

| Apr 2003 | 22 years | |

| Online | Last Post | Last Page |

| Jun 2015 | Jun 2015 | LINK |

| Milestone Posts |

|

| Milestone Years |

|

|

| Location |

|

| Signature |

|

TO BE FIXED |

|

|

Simple answer to the OP..

If house prices increase by only 0.5% more than the average wage does, then it doesn't take a genius to see that there will fairly quickly come a point where people can't keep up with house prices.

We fairly obviously passed that point some time back, but I can't see anyone selling their house for less than they paid, can you? It's going to be desperation times for some though.

|

|

|

|

| Rank | Posts | Team |

| International Star | 164 | No

Team

Selected |

| Joined | Service | Reputation |

| Jul 2011 | 14 years | |

| Online | Last Post | Last Page |

| Aug 2015 | Aug 2015 | LINK |

| Milestone Posts |

|

| Milestone Years |

|

|

| Location |

|

| Signature |

|

TO BE FIXED |

|

|

In the 1960s, you could get a mortgage that was 3 x a husband's salary + 10% deposit

In the 1980s, they relaxed the rules to 3 x couple's salaries + 5% (and then 0%) deposit

Then in the mid 1980s, it was interest-only endowment mortgages

At the peak (2008 ish), it was 5 x couple's salaries (interest only) + 0% deposit + money from mum and dad + credit cards

Today, we're probably at 4 x couple's salary (repayment) + 10% deposit + bank of mum and dad

We probably should be at 3 x couple's salary (repayment) + 15% deposit.

However, people have been waiting for a proper property crash since 1991 and it's not really happened yet.

As average salaries are not going anywhere, rising prices seem to depend on government subsidies and an increase in demand for homes. There is predicted to be a long term rise in demand, and governments do benefit politically from rising house prices.

In Japan they have, I think, 100 year inter-generational mortgages. Maybe that'll be the next development.

In other words, who knows when the madness will end.

|

|

|

| Rank | Posts | Team |

| International Chairman | 37704 | No

Team

Selected |

| Joined | Service | Reputation |

| May 2002 | 23 years | |

| Online | Last Post | Last Page |

| Aug 2018 | Aug 2018 | LINK |

| Milestone Posts |

|

| Milestone Years |

|

|

| Location |

|

| Signature |

|

TO BE FIXED |

|

| Quote ="tw15"

In Japan they have, I think, 100 year inter-generational mortgages. Maybe that'll be the next development.

In other words, who knows when the madness will end.'"

They've had that on the continent since WW2. Parents leave their offspring a debt rather than an asset. But then again, most continentals view a house as somewhere to live, we have taken a different view since 1980 |

|

|

| Rank | Posts | Team |

| International Chairman | 14845 | No

Team

Selected |

| Joined | Service | Reputation |

| Dec 2001 | 23 years | |

| Online | Last Post | Last Page |

| Oct 2021 | Jul 2021 | LINK |

| Milestone Posts |

|

| Milestone Years |

|

|

| Location |

|

| Signature |

|

TO BE FIXED |

|

| Quote ="tw15"

We probably should be at 3 x couple's salary (repayment) + 15% deposit.

'"

That's too high. We should be at 2.5 times one salary. Otherwise, kids suffer through two parents working and society starts falling apart. What I really hate to see is the toddlers being dumped in nurseries near our local train station whilst their dads go off to work in London (presumably because their mother's have already gone). These are parents with good salaries. If they cared about their children they'd move to a lower cost housing area (5 miles away you can get nice property for a third of the price) and one would look after the children. |

|

|

|

| Rank | Posts | Team |

| Club Coach | 14135 | No

Team

Selected |

| Joined | Service | Reputation |

| Oct 2004 | 20 years | |

| Online | Last Post | Last Page |

| Apr 2019 | Apr 2019 | LINK |

| Milestone Posts |

|

| Milestone Years |

|

|

| Location |

|

| Signature |

|

TO BE FIXED |

|

|

I'm not sure where the idea that if you are from a certain area, you should de facto be able to buy in that area.

It's true that people's expectations are a little high sometimes. I've lost count of the amount of times I've registered applicants who want something that doesn't exist. A terraced house, not on a main road, with gardens and a drive, for instance. Then there are those with the 'I want it all, and I want it now' attitude, whilst not having the income to support those ambitions.

But I digress, the simplest solution would be that if you want to buy, move to an area you can afford, and attempt to trade up at a later date. But that's very simplistic, and effectively supports a theory that people will accept anything, when that's not the case.

The government have brought in 'firstbuy', which helps first time buyers financially. The trouble is, it's only available on new homes, which helps no-one except the builders building them. Those properties are empty, so it won't get any chains moving, and therefore won't help anyone trying to sell their homes.

Now if they offered a similar scheme on ALL properties below, say, the average for the area, it would be great. FTB could buy a terraced house, the sellers of which could then trade up to a semi and so on.

In terms of prices being unsustainable. Look, you're always going to get people who can and can't afford houses. It's always been like that, and whilst it's very noble suggesting that 'affordable' houses should be built, that then opens up a massive can of worms in that you have to put all sorts of covenants on to ensure they remain affordable when they're sold on.

You have to ban investors from buying them, which on one hand is great because it means those properties remain in owner-occupant hands (where they should be), but in reality, handicaps you because it then severely limits your chance of selling. In that price range, investors make up a HUGE percentage of your buyers.

Then you have the social stigma to contend with. It's wrong, of course, but you WILL get people comparing them with the old 'council estates', only this time, because they're owner occupied, you've not got the council performing routine maintenance. If everyone is on a low income, how long do you think it will be before the houses start to look a little tired, because the owners can't afford to repair them?

Basically, all you're doing is transferring a problem that is dotted around, and concentrating them onto large estates, and it won't be long before people are shouting about how the Tories want to round them all up and stigmatise these people. Did any of you think of that?

|

|

|

| Rank | Posts | Team |

| Club Coach | 14135 | No

Team

Selected |

| Joined | Service | Reputation |

| Oct 2004 | 20 years | |

| Online | Last Post | Last Page |

| Apr 2019 | Apr 2019 | LINK |

| Milestone Posts |

|

| Milestone Years |

|

|

| Location |

|

| Signature |

|

TO BE FIXED |

|

| Quote ="tw15"

We probably should be at 3 x couple's salary (repayment) + 15% deposit.

'"

No. Between 5-10% is sufficient.

There are two reasons for this - the obvious one is the ability to save up the deposit. If the buyer has no deposit, then you have no buyer. It's as simple as that.

The other is less obvious. Banks are not in the business of taking risks, and therefore want an effective cast iron guarantee that if they repossess your house, they can sell it on for more than they have lent you. Otherwise, they need to chase you for the balance, which they'll probably never get, and incurs costs.

A couple of years ago where falls were predicted to be about the 15% mark, then yes, banks are justified (in their own minds anyway) asking for a 20% deposit. The loss lies with you, not the bank, then.

However now, prices seem to be stabilising somewhat, and no matter what the scaremongers say, further falls of 15% are unlikely. The banks acknowledge this, because there are 95% LTV mortgages on the market, albeit with a staggering interest rate. 90% is more the norm. |

|

|

| Rank | Posts | Team |

| International Chairman | 47951 | No

Team

Selected |

| Joined | Service | Reputation |

| May 2002 | 23 years | |

| Online | Last Post | Last Page |

| Aug 2017 | Jul 2017 | LINK |

| Milestone Posts |

|

| Milestone Years |

|

|

| Location |

|

| Signature |

|

TO BE FIXED |

|

|

|

|

|

| Rank | Posts | Team |

| International Chairman | 14522 | No

Team

Selected |

| Joined | Service | Reputation |

| Feb 2002 | 23 years | |

| Online | Last Post | Last Page |

| Jan 2014 | Jan 2014 | LINK |

| Milestone Posts |

|

| Milestone Years |

|

|

| Location |

|

| Signature |

|

TO BE FIXED |

|

| Quote ="ROBINSON"No. Between 5-10% is sufficient.

There are two reasons for this - the obvious one is the ability to save up the deposit. If the buyer has no deposit, then you have no buyer. It's as simple as that.

The other is less obvious. Banks are not in the business of taking risks, and therefore want an effective cast iron guarantee that if they repossess your house, they can sell it on for more than they have lent you. Otherwise, they need to chase you for the balance, which they'll probably never get, and incurs costs.

A couple of years ago where falls were predicted to be about the 15% mark, then yes, banks are justified (in their own minds anyway) asking for a 20% deposit. The loss lies with you, not the bank, then.

However now, prices seem to be stabilising somewhat, and no matter what the scaremongers say, further falls of 15% are unlikely. The banks acknowledge this, because there are 95% LTV mortgages on the market, albeit with a staggering interest rate. 90% is more the norm.'"

Not that long ago, it was fairly common for a building society to ask the borrower to pay a one-off premium for insurance against a price drop (in addition to the deposit).

Also, the deposit (which was commonly saved-up in a building society account) demonstrated to the BS that the borrower had the discipline and the income to repay the mortgage if and when granted.

I don't know whether that one-off premium still happens but I doubt it, I guess the premium would be too high these days.

On the deposits, I reckon you're right that the reasons for the higher deposits currently being demanded are the banks and BSs way of passing the risk of price drops back to the borrower.

Hence we can see their opinion (about likely price-drop-risk) in the level of deposit they require.

Whilst this shows caution, it doesn't mean they are guessing right ... they don't have a great track record when you remember they weren't very careful about handling the gilded turds of US-sub-prime packages. |

|

|

| Rank | Posts | Team |

| International Chairman | 47951 | No

Team

Selected |

| Joined | Service | Reputation |

| May 2002 | 23 years | |

| Online | Last Post | Last Page |

| Aug 2017 | Jul 2017 | LINK |

| Milestone Posts |

|

| Milestone Years |

|

|

| Location |

|

| Signature |

|

TO BE FIXED |

|

| Quote ="El Barbudo"... Shame that they weren't as careful about handling the gilded turds of US-sub-prime packages.'"

RBS: 'Oh no, we don't have any of those toxic debts.

'Ooops. When we bought that there ABN Amro, we didn't check how many toxic debts came with it'. |

|

|

| Rank | Posts | Team |

| Club Coach | 14135 | No

Team

Selected |

| Joined | Service | Reputation |

| Oct 2004 | 20 years | |

| Online | Last Post | Last Page |

| Apr 2019 | Apr 2019 | LINK |

| Milestone Posts |

|

| Milestone Years |

|

|

| Location |

|

| Signature |

|

TO BE FIXED |

|

|

|

|

|

| Rank | Posts | Team |

| Club Coach | 14135 | No

Team

Selected |

| Joined | Service | Reputation |

| Oct 2004 | 20 years | |

| Online | Last Post | Last Page |

| Apr 2019 | Apr 2019 | LINK |

| Milestone Posts |

|

| Milestone Years |

|

|

| Location |

|

| Signature |

|

TO BE FIXED |

|

| Quote ="El Barbudo"Not that long ago, it was fairly common for a building society to ask the borrower to pay a one-off premium for insurance against a price drop (in addition to the deposit).

Also, the deposit (which was commonly saved-up in a building society account) demonstrated to the BS that the borrower had the discipline and the income to repay the mortgage if and when granted.

I don't know whether that one-off premium still happens but I doubt it, I guess the premium would be too high these days.

On the deposits, I reckon you're right that the reasons for the higher deposits currently being demanded are the banks and BSs way of passing the risk of price drops back to the borrower.

Hence we can see their opinion (about likely price-drop-risk) in the level of deposit they require.

Whilst this shows caution, it doesn't mean they are guessing right ... they don't have a great track record when you remember they weren't very careful about handling the gilded turds of US-sub-prime packages.'"

That's right, they were called MIG (Mortgage Indemnity Guarantee) premiums, I think. I didn't mention it because, like you, I'm not sure if they still exist. By that, I mean I'm not sure if they were withdrawn, or they stopped selling them because of rapidly inflating prices. |

|

|

| Rank | Posts | Team |

| International Chairman | 28357 | No

Team

Selected |

| Joined | Service | Reputation |

| Feb 2002 | 23 years | |

| Online | Last Post | Last Page |

| May 2024 | Oct 2019 | LINK |

| Milestone Posts |

|

| Milestone Years |

|

|

| Location |

|

| Signature |

|

TO BE FIXED |

|

| Quote ="Mintball"RBS: 'Oh no, we don't have any of those toxic debts.

'Ooops. When we bought that there ABN Amro, we didn't check how many toxic debts came with it'.'"

Quote ="Fred the Shred, in foreword to RBS’s 2006 annual report"

"Sound control of risk is fundamental to the Group’s business... Central to this is our long-standing aversion to sub-prime lending, wherever we do business.”'" |

|

|

| Rank | Posts | Team |

| International Chairman | 47951 | No

Team

Selected |

| Joined | Service | Reputation |

| May 2002 | 23 years | |

| Online | Last Post | Last Page |

| Aug 2017 | Jul 2017 | LINK |

| Milestone Posts |

|

| Milestone Years |

|

|

| Location |

|

| Signature |

|

TO BE FIXED |

|

| Quote ="ROBINSON"What's so funny about that?

I should have said, to be fair, the RETAIL banking side of our banks are not in the business of taking risks.'"

Funny in a dark and ironic sort of way, since it's risky behaviour that has created the whole sorry financial crisis in the first place. |

|

|

| Rank | Posts | Team |

| Club Coach | 14135 | No

Team

Selected |

| Joined | Service | Reputation |

| Oct 2004 | 20 years | |

| Online | Last Post | Last Page |

| Apr 2019 | Apr 2019 | LINK |

| Milestone Posts |

|

| Milestone Years |

|

|

| Location |

|

| Signature |

|

TO BE FIXED |

|

| Quote ="Mintball"Funny in a dark and ironic sort of way, since it's risky behaviour that has created the whole sorry financial crisis in the first place.'"

Sorry, I'll start again because I wasn't clear.

What I meant to say was that the retail side of banks, since the crash, are not in the business of taking risks. |

|

|

| Rank | Posts | Team |

| International Chairman | 14522 | No

Team

Selected |

| Joined | Service | Reputation |

| Feb 2002 | 23 years | |

| Online | Last Post | Last Page |

| Jan 2014 | Jan 2014 | LINK |

| Milestone Posts |

|

| Milestone Years |

|

|

| Location |

|

| Signature |

|

TO BE FIXED |

|

| Quote ="Mintball"Funny in a dark and ironic sort of way, since it's risky behaviour that has created the whole sorry financial crisis in the first place.'"

Indeed, and risky in the sense that it was far more risky to the investor than to the pinstriped e-monger who was notching up incredible bonuses at no risk to himself.

A couple of the basic tenets of the perfect market are a) That full information is available and b) That self-interest will prevail in prevention of risk.

Neither was in evidence.

Economics, as she is spoke, is in tatters. |

|

|

| Rank | Posts | Team |

| Player Coach | 10852 | No

Team

Selected |

| Joined | Service | Reputation |

| Oct 2006 | 18 years | |

| Online | Last Post | Last Page |

| Jan 2018 | Aug 2016 | LINK |

| Milestone Posts |

|

| Milestone Years |

|

|

| Location |

|

| Signature |

|

TO BE FIXED |

|

| Quote ="ROBINSON"Sorry, I'll start again because I wasn't clear.

What I meant to say was that the retail side of banks, since the crash, are not in the business of taking risks.'"

Wow. We've gone from 'banks aren't in the business of taking risks' to 'the retail side of banks aren't in the business of taking risks since the crash'.

Back-pedalling much? If not, you should really learn to say what you mean. |

|

|

| Rank | Posts | Team |

| International Chairman | 32466 | No

Team

Selected |

| Joined | Service | Reputation |

| Feb 2002 | 23 years | |

| Online | Last Post | Last Page |

| Aug 2018 | Aug 2018 | LINK |

| Milestone Posts |

|

| Milestone Years |

|

|

| Location |

|

| Signature |

|

TO BE FIXED |

|

| Quote ="ROBINSON"

The government have brought in 'firstbuy', which helps first time buyers financially. The trouble is, it's only available on new homes, which helps no-one except the builders building them. Those properties are empty, so it won't get any chains moving, and therefore won't help anyone trying to sell their homes.

Now if they offered a similar scheme on ALL properties below, say, the average for the area, it would be great. FTB could buy a terraced house, the sellers of which could then trade up to a semi and so on.

'"

I haven't any experience of the new "firstbuy" scheme but three years ago when we were looking at houses on new developments, all of those developments were only possible because they had an element of "affordable" housing on the then Labour government scheme which I think was called "Homebuyer" using shared equity and other schemes to get first time buyers into new housing with minimum deposit and affordable short term repayments - those houses were always sold off plan on all of the developments we looked at, indeed those houses were always the first ones to be built on each site simply because they were sold before the foundations were dug.

I don't know what the difference is between the two schemes but the former was extremely successful during the 07/08 recession and saved many builders and sub trades from failure.

I do agree with your second point though, my kids are of an age now where they are looking at their own house/flat in the next year or so, the friends in their age groups who have already moved out are all renting, they don't know anyone who is buying at all. |

|

|

| Rank | Posts | Team |

| Player Coach | 2471 | No

Team

Selected |

| Joined | Service | Reputation |

| Aug 2006 | 18 years | |

| Online | Last Post | Last Page |

| Jan 2019 | May 2016 | LINK |

| Milestone Posts |

|

| Milestone Years |

|

|

| Location |

|

| Signature |

|

TO BE FIXED |

|

|

I have a friend who bought using the first buy scheme, about 12 months after we bought our house using a standard mortgage.

He seems to be paying more out with his mortgaged portion plus the rent for the other half than I do for my mortgage, with the added bonus that he can only buy the other bit in specified amounts at specified times. His reasoning for doing it I believe was that he wouldn't of been able to afford the deposit otherwise.

As for the OP, house prices can't afford to go do massively as I can only see how that would lead to more problems.

|

|

|

|

|